The world faces mounting threats to its biodiversity, from the endangered black rhinoceros in South Africa to the diminishing Amazon rainforest. Safeguarding biodiversity—comprising animals, plants, and ecosystems—is crucial for sustaining our planet's health and the essential services and economic activities on which we depend. Despite its critical role, biodiversity has not historically been a priority for investors.

This oversight is surprising considering biodiversity's significance as the living aspect of our natural world. Together with abiotic resources like land, water, and minerals, biodiversity forms natural capital—the foundation of our planet's assets. Natural capital provides the essential elements for ecosystem services, which are the benefits societies and economies derive from nature, sustaining life and generating wealth. The loss of biodiversity alone could result in trillions of dollars in economic losses in the coming years, compounded by the costs of climate change.

Biodiversity serves as the fundamental life support system of our planet, underpinning the production of nearly all goods and services.

The complexity of biodiversity risks stems from the intricate web of interconnections within and between ecosystems. Ecosystem services, which encompass the regulation of natural processes, provision of physical products like food, cultural benefits, and essential infrastructure such as oxygen production and soil formation, are deeply intertwined. Recognizing this interconnectedness is crucial, especially in light of the drivers of biodiversity loss, such as changing land and sea use. Deforestation, for instance, has led to a significant decline in wildlife populations according to the World Wildlife Fund, underscoring the urgent need to address these threats.

Deforestation not only impacts wildlife but also has ramifications for the climate. For instance, the Amazon rainforest now absorbs 30% less carbon dioxide compared to the 1990s due to deforestation for cattle farms, diminishing its ability to store and release moisture into the atmosphere.

This decline in moisture from the Amazon has significant implications for the global hydrological cycle, affecting rain, evaporation, freezing, and melting processes worldwide, further altering species habitats and the global climate. Expanding deforestation in the Amazon by 20% could result in the release of over 90 billion tons of CO2 into the atmosphere, surpassing annual global fossil fuel emissions by 2.5 times.

There is a positive aspect, as interconnectedness operates in both directions: addressing climate change and biodiversity loss concurrently can yield dual benefits. Measures to curb deforestation in the Amazon, for instance, may mitigate the pace and severity of climate change by establishing additional carbon sinks to absorb carbon emissions.

The National Academy of Sciences in the US emphasized the nexus between nature and climate by estimating that, in a scenario aiming for below 2 degrees Celsius warming, nature-based solutions such as green infrastructure and carbon sequestration and storage could contribute to 37% of necessary carbon mitigation by 2030 and 20% by 2050.

In essence, addressing biodiversity loss and climate change simultaneously offers a pathway to addressing two systemic issues. Likewise, recognizing the interconnections between biodiversity and climate risks can assist investors in identifying valuable insights and investment opportunities for their portfolios, including carbon credits, agricultural solutions, ecotourism, water management, and green infrastructure.

The complexity of risk amplifies when considering other drivers of biodiversity loss, including direct exploitation, pollution, and invasive species, alongside land and sea-use changes and climate change. Rankings of these drivers may evolve over time, adding another layer of complexity. Neglecting to mitigate climate change could elevate it to the primary cause of biodiversity loss in the future.

Investors confront an urgent task in assessing and managing these risks and opportunities. As biodiversity loss persists, the risks to companies and investment portfolios escalate, prompting governments and regulators to respond, thereby intensifying the pressure on businesses and investors to engage with these issues and seize opportunities.

Assisting Investors in Confronting the Challenge

The task of assessing and managing risks and opportunities related to nature is certainly daunting. However, investors can adopt practical measures to address biodiversity risk by comprehending its role within the broader ecological framework, its significance in supporting ecosystem services, and the intricate interactions among these services that sustain life and economic operations.

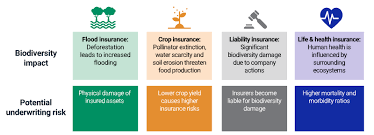

Subsequently, investors can establish a framework for evaluating companies' exposure to biodiversity risks, encompassing not only physical and transition risks but also the potential economic and investment prospects stemming from efforts to mitigate biodiversity loss and climate change. Through the application of well-designed conceptual frameworks and specialized data, biodiversity risks and opportunities can be assessed at both sector and individual issuer levels, enabling investors to align them with their portfolios and potentially enhance returns.

Implementing these strategies within an active approach that integrates fundamental research, insights from third-party specialists, and engagement with issuers and stewardship, investors can pursue meaningful long-term performance while contributing to the mitigation of nature-related business and investment risks.

Although these measures alone may not resolve the biodiversity crisis, they can contribute to shaping a world where economies behave more akin to ecosystems and less like invasive species.

For an in-depth exploration of the risks and opportunities associated with this topic, you can access our white paper, "Biodiversity in the Balance: How Nature Poses Investment Risks and Opportunities."

*AB engages with issuers when it deems such engagement to be in the best interest of its clients.

The authors express their gratitude to Max Lulavy, Environmental Research Associate, for his invaluable contributions to this research.

The opinions expressed herein do not constitute research, investment advice, or trade recommendations and may not necessarily reflect the views of all AB portfolio-management teams. These views are subject to revision over time.

This oversight is surprising considering biodiversity's significance as the living aspect of our natural world. Together with abiotic resources like land, water, and minerals, biodiversity forms natural capital—the foundation of our planet's assets. Natural capital provides the essential elements for ecosystem services, which are the benefits societies and economies derive from nature, sustaining life and generating wealth. The loss of biodiversity alone could result in trillions of dollars in economic losses in the coming years, compounded by the costs of climate change.

Biodiversity serves as the fundamental life support system of our planet, underpinning the production of nearly all goods and services.

The complexity of biodiversity risks stems from the intricate web of interconnections within and between ecosystems. Ecosystem services, which encompass the regulation of natural processes, provision of physical products like food, cultural benefits, and essential infrastructure such as oxygen production and soil formation, are deeply intertwined. Recognizing this interconnectedness is crucial, especially in light of the drivers of biodiversity loss, such as changing land and sea use. Deforestation, for instance, has led to a significant decline in wildlife populations according to the World Wildlife Fund, underscoring the urgent need to address these threats.

Deforestation not only impacts wildlife but also has ramifications for the climate. For instance, the Amazon rainforest now absorbs 30% less carbon dioxide compared to the 1990s due to deforestation for cattle farms, diminishing its ability to store and release moisture into the atmosphere.

This decline in moisture from the Amazon has significant implications for the global hydrological cycle, affecting rain, evaporation, freezing, and melting processes worldwide, further altering species habitats and the global climate. Expanding deforestation in the Amazon by 20% could result in the release of over 90 billion tons of CO2 into the atmosphere, surpassing annual global fossil fuel emissions by 2.5 times.

There is a positive aspect, as interconnectedness operates in both directions: addressing climate change and biodiversity loss concurrently can yield dual benefits. Measures to curb deforestation in the Amazon, for instance, may mitigate the pace and severity of climate change by establishing additional carbon sinks to absorb carbon emissions.

The National Academy of Sciences in the US emphasized the nexus between nature and climate by estimating that, in a scenario aiming for below 2 degrees Celsius warming, nature-based solutions such as green infrastructure and carbon sequestration and storage could contribute to 37% of necessary carbon mitigation by 2030 and 20% by 2050.

In essence, addressing biodiversity loss and climate change simultaneously offers a pathway to addressing two systemic issues. Likewise, recognizing the interconnections between biodiversity and climate risks can assist investors in identifying valuable insights and investment opportunities for their portfolios, including carbon credits, agricultural solutions, ecotourism, water management, and green infrastructure.

The complexity of risk amplifies when considering other drivers of biodiversity loss, including direct exploitation, pollution, and invasive species, alongside land and sea-use changes and climate change. Rankings of these drivers may evolve over time, adding another layer of complexity. Neglecting to mitigate climate change could elevate it to the primary cause of biodiversity loss in the future.

Investors confront an urgent task in assessing and managing these risks and opportunities. As biodiversity loss persists, the risks to companies and investment portfolios escalate, prompting governments and regulators to respond, thereby intensifying the pressure on businesses and investors to engage with these issues and seize opportunities.

Assisting Investors in Confronting the Challenge

The task of assessing and managing risks and opportunities related to nature is certainly daunting. However, investors can adopt practical measures to address biodiversity risk by comprehending its role within the broader ecological framework, its significance in supporting ecosystem services, and the intricate interactions among these services that sustain life and economic operations.

Subsequently, investors can establish a framework for evaluating companies' exposure to biodiversity risks, encompassing not only physical and transition risks but also the potential economic and investment prospects stemming from efforts to mitigate biodiversity loss and climate change. Through the application of well-designed conceptual frameworks and specialized data, biodiversity risks and opportunities can be assessed at both sector and individual issuer levels, enabling investors to align them with their portfolios and potentially enhance returns.

Implementing these strategies within an active approach that integrates fundamental research, insights from third-party specialists, and engagement with issuers and stewardship, investors can pursue meaningful long-term performance while contributing to the mitigation of nature-related business and investment risks.

Although these measures alone may not resolve the biodiversity crisis, they can contribute to shaping a world where economies behave more akin to ecosystems and less like invasive species.

For an in-depth exploration of the risks and opportunities associated with this topic, you can access our white paper, "Biodiversity in the Balance: How Nature Poses Investment Risks and Opportunities."

*AB engages with issuers when it deems such engagement to be in the best interest of its clients.

The authors express their gratitude to Max Lulavy, Environmental Research Associate, for his invaluable contributions to this research.

The opinions expressed herein do not constitute research, investment advice, or trade recommendations and may not necessarily reflect the views of all AB portfolio-management teams. These views are subject to revision over time.

Unlocking Investment Opportunities: Navigating Biodiversity Risks for Sustainable Returns

Unlocking Investment Opportunities: Navigating Biodiversity Risks for Sustainable Returns

Companies

Companies