A diversified strategy towards sustainable investing offers a comprehensive and well-rounded spectrum of options. Investors are drawn to sustainable methods due to their potential for high returns and the ability to align with environmental or social themes. For many, this involves exploring a wide array of sustainable investment categories, including equities, fixed income, and unconventional alternatives like real estate and infrastructure.

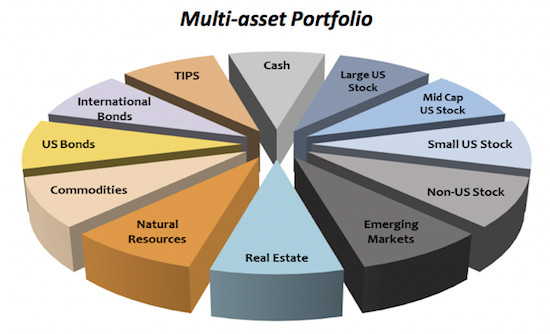

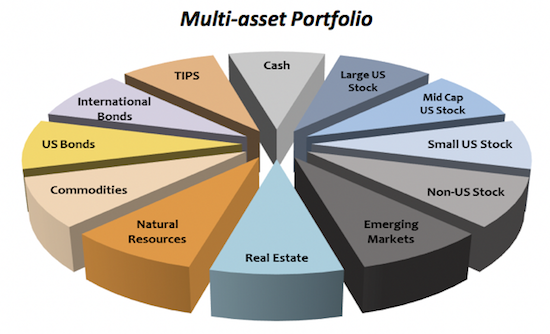

Sustainability in Investing Can Be Achieved Through Balance We believe that the extensive universe of sustainable investments offers another potential advantage when applied effectively and consistently: balance.

A multi-asset approach, when unrestricted, can utilize a diverse set of sustainable investment components to seek returns and adjust risk levels over time. This is crucial for investors who prefer a smoother investment journey.

Investments Should Align with Global Sustainability Themes The optimal entry point for potential sustainable investments are businesses whose operations align with one or more of the 17 United Nations Sustainable Development Goals (UN SDGs). To date, 193 countries have committed to achieving the UN SDG targets, which focus on economic prosperity, environmental conservation, and social inclusion. It is estimated that approximately US$90 trillion in global investments will be required to achieve these targets by 2030.

Companies that align with the UN SDGs can benefit from these strong tailwinds, and they offer a guide to thematic opportunities across various investments for the foreseeable future. We believe health, climate, and empowerment are among the most relevant and compelling themes, given the wide range of supportive sub-themes.

More Options, Lower Volatility While stocks have historically offered the highest long-term return potential compared to other assets, they are subject to short-term volatility and losses. Nevertheless, equities remain a crucial component in a sustainable portfolio, especially as more businesses enter the ESG space and global opportunities increase.

For example, US-based Hexcel produces lightweight carbon fiber that replaces steel and aluminum in airplanes, improving fuel efficiency and contributing to climate goals. Similarly, Adobe enables companies through its digital enterprise resources, leaving a minimal carbon footprint.

Bonds that align with global sustainability themes also provide additional tools that multi-asset portfolios can utilize to make dynamic adjustments as market conditions change. For instance, the demand for ESG-labeled bonds is skyrocketing, with the issuance of green bonds alone reaching nearly US$4 trillion at the end of 2022, as reported by the World Bank.

Understanding the Diversity of ESG-Labeled Bonds It’s crucial to comprehend how each ESG-labeled bond can uniquely enhance a sustainable portfolio. These bonds can be broadly classified into two categories: use of proceeds, and sustainability linked.

Use-of-proceeds bonds are used to finance specific green or social projects. For instance, Ørsted, a Danish energy provider aiming to use 99% renewable sources by 2025, will use the proceeds from its green bonds to fund offshore wind farms and other renewable energy projects, convert gas and coal plants to sustainable biomass, and invest in clean energy storage. On the other hand, the proceeds from social bonds issued by Scotland-based commercial bank NatWest Group are intended solely for funding women-led businesses.

Unlike financing individual projects, sustainability-linked bonds (SLBs) require issuers to meet specified sustainable key performance indicators within a certain timeframe at the company level. If targets are not met, SLB frameworks may stipulate higher coupons as an incentive. For example, Greece-based PPC failed to meet its decarbonization target by the end of 2022, resulting in a 0.25% increase in its coupon in March 2023.

Some ESG-labeled bonds may not have specific green or social targets for proceeds, but the issuer has set certain sustainability targets that it seeks to achieve. For example, US Acute Care Solutions, a physician-owned provider of medicine, hospitals, and observation services, aligns strongly with UN SDG health themes. The company is very employee-centric, based on a “democratic ownership” model. Its in-network business model offers lower-than-average pricing compared to peers, and it takes measurable steps to ensure patient access to quality care while managing costs and fostering a diverse and inclusive workplace.

Discussing Waste, Trains, and Tap Water The diversification benefits of ESG-labeled bonds can be extended further, considering that issuers range from non-profit organizations and provinces to sovereign nations.

Engagement, much like security selection, is a significant part of the screening and integration process. Engagement involves meeting with issuers, reviewing their sustainability goals, and even encouraging them to set more ambitious targets to attract investors.

AB frequently takes part in the early stages of defining the purpose and scope of an upcoming bond. For instance, in 2022, Canada’s finance department invited us to share our views on a proposed seven-year ESG-labeled environmental bond, which, at C$5 billion, was one of the country’s largest and most comprehensive. The proceeds from the bond were planned to fund nationwide biodiversity programs, cleaner transportation projects, improvements in wastewater management, increased renewable energy, and other initiatives. AB has maintained ongoing engagement with the Canadian government on topics such as green bond impact reports and future ESG-labeled bonds and frameworks.

The Role of Alternative Assets in Healthy Diversification The conventional diversification benefits of stocks and bonds may not always be dependable, as evidenced in 2022. For this and other reasons, we believe that sustainable multi-asset investors should consider cautiously expanding into non-traditional assets, which are becoming an increasingly significant part of the ESG landscape. Current alternatives include digital infrastructure, such as energy-efficient smart buildings and renewable energy generation.

Regional exposure is also important, as is a variety of styles (low volatility versus growth stocks) and low-correlating factors such as hedge fund premia and options. The integration of measured, complementary exposure among these outliers can help counteract biases that may gradually emerge. This assists in managing short-term volatility while enhancing diversification in issuers that contribute to positive environmental and social outcomes.

The construction of sustainable multi-asset portfolios aims to combine the best opportunities across asset classes and the ESG universe. We believe that the effective integration of these ideas, including tactical adjustments when conditions change, can help manage downside risk and provide a more balanced sustainable investing experience.

To know more about AB’s approach to responsibility click here.

Sustainability in Investing Can Be Achieved Through Balance We believe that the extensive universe of sustainable investments offers another potential advantage when applied effectively and consistently: balance.

A multi-asset approach, when unrestricted, can utilize a diverse set of sustainable investment components to seek returns and adjust risk levels over time. This is crucial for investors who prefer a smoother investment journey.

Investments Should Align with Global Sustainability Themes The optimal entry point for potential sustainable investments are businesses whose operations align with one or more of the 17 United Nations Sustainable Development Goals (UN SDGs). To date, 193 countries have committed to achieving the UN SDG targets, which focus on economic prosperity, environmental conservation, and social inclusion. It is estimated that approximately US$90 trillion in global investments will be required to achieve these targets by 2030.

Companies that align with the UN SDGs can benefit from these strong tailwinds, and they offer a guide to thematic opportunities across various investments for the foreseeable future. We believe health, climate, and empowerment are among the most relevant and compelling themes, given the wide range of supportive sub-themes.

More Options, Lower Volatility While stocks have historically offered the highest long-term return potential compared to other assets, they are subject to short-term volatility and losses. Nevertheless, equities remain a crucial component in a sustainable portfolio, especially as more businesses enter the ESG space and global opportunities increase.

For example, US-based Hexcel produces lightweight carbon fiber that replaces steel and aluminum in airplanes, improving fuel efficiency and contributing to climate goals. Similarly, Adobe enables companies through its digital enterprise resources, leaving a minimal carbon footprint.

Bonds that align with global sustainability themes also provide additional tools that multi-asset portfolios can utilize to make dynamic adjustments as market conditions change. For instance, the demand for ESG-labeled bonds is skyrocketing, with the issuance of green bonds alone reaching nearly US$4 trillion at the end of 2022, as reported by the World Bank.

Understanding the Diversity of ESG-Labeled Bonds It’s crucial to comprehend how each ESG-labeled bond can uniquely enhance a sustainable portfolio. These bonds can be broadly classified into two categories: use of proceeds, and sustainability linked.

Use-of-proceeds bonds are used to finance specific green or social projects. For instance, Ørsted, a Danish energy provider aiming to use 99% renewable sources by 2025, will use the proceeds from its green bonds to fund offshore wind farms and other renewable energy projects, convert gas and coal plants to sustainable biomass, and invest in clean energy storage. On the other hand, the proceeds from social bonds issued by Scotland-based commercial bank NatWest Group are intended solely for funding women-led businesses.

Unlike financing individual projects, sustainability-linked bonds (SLBs) require issuers to meet specified sustainable key performance indicators within a certain timeframe at the company level. If targets are not met, SLB frameworks may stipulate higher coupons as an incentive. For example, Greece-based PPC failed to meet its decarbonization target by the end of 2022, resulting in a 0.25% increase in its coupon in March 2023.

Some ESG-labeled bonds may not have specific green or social targets for proceeds, but the issuer has set certain sustainability targets that it seeks to achieve. For example, US Acute Care Solutions, a physician-owned provider of medicine, hospitals, and observation services, aligns strongly with UN SDG health themes. The company is very employee-centric, based on a “democratic ownership” model. Its in-network business model offers lower-than-average pricing compared to peers, and it takes measurable steps to ensure patient access to quality care while managing costs and fostering a diverse and inclusive workplace.

Discussing Waste, Trains, and Tap Water The diversification benefits of ESG-labeled bonds can be extended further, considering that issuers range from non-profit organizations and provinces to sovereign nations.

Engagement, much like security selection, is a significant part of the screening and integration process. Engagement involves meeting with issuers, reviewing their sustainability goals, and even encouraging them to set more ambitious targets to attract investors.

AB frequently takes part in the early stages of defining the purpose and scope of an upcoming bond. For instance, in 2022, Canada’s finance department invited us to share our views on a proposed seven-year ESG-labeled environmental bond, which, at C$5 billion, was one of the country’s largest and most comprehensive. The proceeds from the bond were planned to fund nationwide biodiversity programs, cleaner transportation projects, improvements in wastewater management, increased renewable energy, and other initiatives. AB has maintained ongoing engagement with the Canadian government on topics such as green bond impact reports and future ESG-labeled bonds and frameworks.

The Role of Alternative Assets in Healthy Diversification The conventional diversification benefits of stocks and bonds may not always be dependable, as evidenced in 2022. For this and other reasons, we believe that sustainable multi-asset investors should consider cautiously expanding into non-traditional assets, which are becoming an increasingly significant part of the ESG landscape. Current alternatives include digital infrastructure, such as energy-efficient smart buildings and renewable energy generation.

Regional exposure is also important, as is a variety of styles (low volatility versus growth stocks) and low-correlating factors such as hedge fund premia and options. The integration of measured, complementary exposure among these outliers can help counteract biases that may gradually emerge. This assists in managing short-term volatility while enhancing diversification in issuers that contribute to positive environmental and social outcomes.

The construction of sustainable multi-asset portfolios aims to combine the best opportunities across asset classes and the ESG universe. We believe that the effective integration of these ideas, including tactical adjustments when conditions change, can help manage downside risk and provide a more balanced sustainable investing experience.

To know more about AB’s approach to responsibility click here.

Balancing Sustainable Investing: Diversification through Multi-Asset Portfolios

Balancing Sustainable Investing: Diversification through Multi-Asset Portfolios

Companies

Companies