What do short-term pressures on China’s battery electric vehicle (BEV) industry mean for its long-term prospects?

China has rapidly emerged as a dominant force in the global BEV market, both in production and demand. While this dominance is expected to persist, the industry—both in China and worldwide—faces challenges. Investors must navigate these short-term risks while positioning for long-term opportunities.

The shift from internal combustion engines (ICE) to electric vehicles (EVs) globally is well-established and is projected to grow as countries strive to reduce carbon emissions. Among EVs, the BEV segment is expected to maintain its strong growth trajectory, distinct from hybrid and plug-in hybrid electric vehicles.

China leads the BEV market in both manufacturing and demand, although its production has recently decelerated. This shift reflects a change in the industry’s growth dynamics, and investors must understand these changes to assess the long-term outlook.

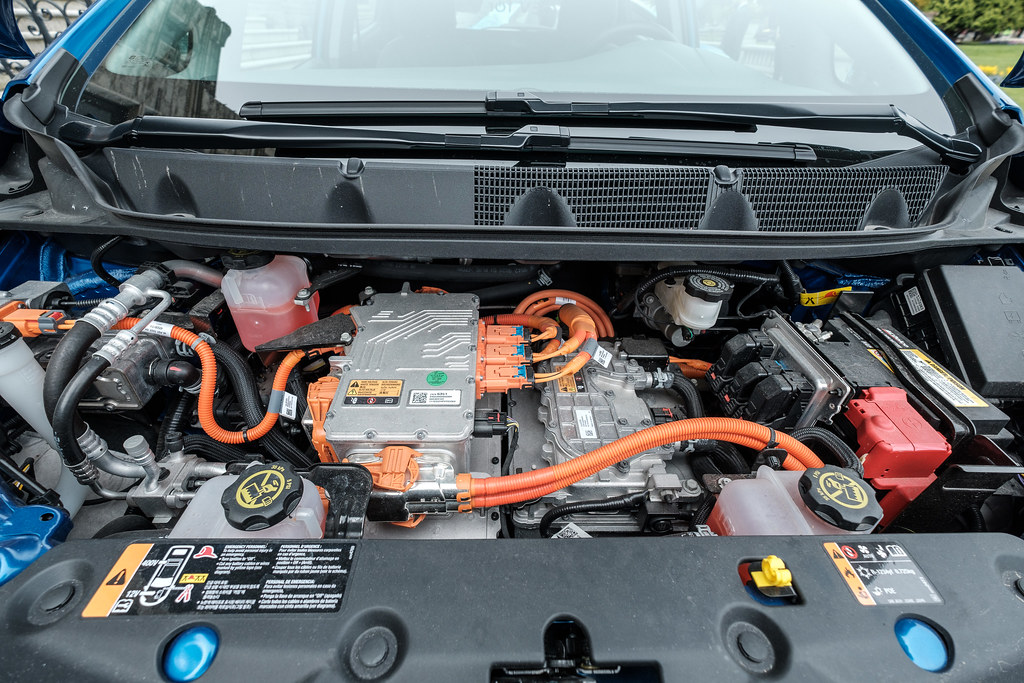

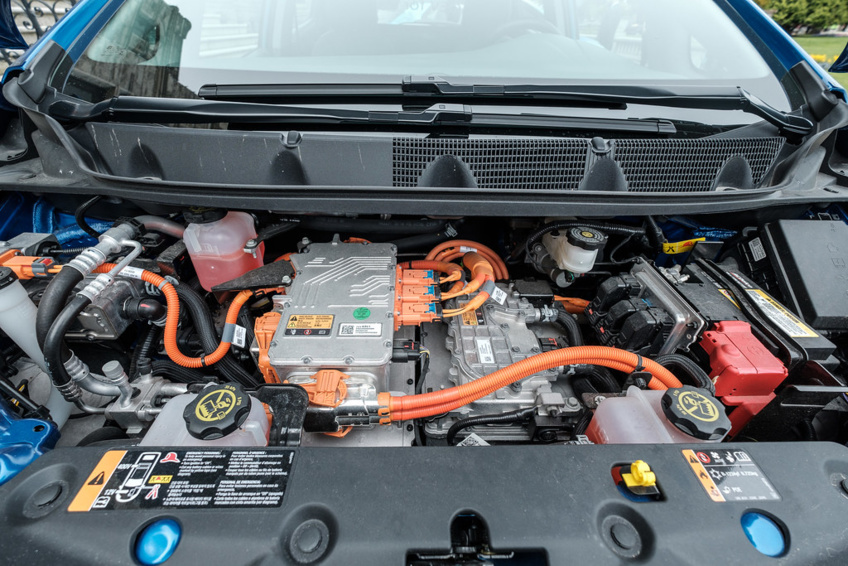

China's rapid rise to BEV leadership began in the early 2000s, driven by the government’s realization that its traditional ICE manufacturing was unlikely to surpass the U.S., Europe, or Japan. With an advantage in hybrid vehicles already held by Japan, China focused on BEVs, supported by government subsidies and the establishment of factories by global BEV players like Tesla. This included fostering its battery manufacturing capabilities, particularly in lithium iron phosphate (LFP) batteries, which China has since perfected.

Despite producing 6.2 million BEVs in 2023—more than half of the global total—China’s BEV sector faces hurdles. The number of manufacturers has declined, and further industry consolidation is anticipated.

Short-term challenges include slowing BEV sales due to competition from cheaper plug-in hybrids and limited battery-charging infrastructure in lower-tier Chinese cities. Additionally, Chinese BEV exports face resistance in key markets like the European Union, Canada, and the U.S. due to higher tariffs.

Despite these near-term pressures, the long-term outlook appears promising. Trade barriers may be mitigated by increased BEV exports to emerging markets, and the Chinese industry’s scale and technological sophistication position it well for future competition.

China’s structural advantages, including its leadership in LFP batteries and control over the battery supply chain, remain critical. While the U.S. and European markets seek to counter China’s dominance through tariffs, these strategies may not have a lasting impact, especially as China has phased out national subsidies for EV manufacturers and battery sales.

In the long run, China's low-cost, high-quality BEVs could challenge traditional ICE manufacturers, forcing them to lower prices and accept reduced margins. Investors should watch for signs of industry maturation, such as reduced price competition and stabilized market shares.

Western automakers face their own pressures, as they must expand their EV portfolios to secure their futures. Meanwhile, China’s BEV makers and battery manufacturers are well-positioned to thrive in the evolving global market.

The opinions provided here are not intended as research, investment advice, or trade recommendations and may not reflect the perspectives of all AB portfolio management teams. These views are subject to change over time.

China has rapidly emerged as a dominant force in the global BEV market, both in production and demand. While this dominance is expected to persist, the industry—both in China and worldwide—faces challenges. Investors must navigate these short-term risks while positioning for long-term opportunities.

The shift from internal combustion engines (ICE) to electric vehicles (EVs) globally is well-established and is projected to grow as countries strive to reduce carbon emissions. Among EVs, the BEV segment is expected to maintain its strong growth trajectory, distinct from hybrid and plug-in hybrid electric vehicles.

China leads the BEV market in both manufacturing and demand, although its production has recently decelerated. This shift reflects a change in the industry’s growth dynamics, and investors must understand these changes to assess the long-term outlook.

China's rapid rise to BEV leadership began in the early 2000s, driven by the government’s realization that its traditional ICE manufacturing was unlikely to surpass the U.S., Europe, or Japan. With an advantage in hybrid vehicles already held by Japan, China focused on BEVs, supported by government subsidies and the establishment of factories by global BEV players like Tesla. This included fostering its battery manufacturing capabilities, particularly in lithium iron phosphate (LFP) batteries, which China has since perfected.

Despite producing 6.2 million BEVs in 2023—more than half of the global total—China’s BEV sector faces hurdles. The number of manufacturers has declined, and further industry consolidation is anticipated.

Short-term challenges include slowing BEV sales due to competition from cheaper plug-in hybrids and limited battery-charging infrastructure in lower-tier Chinese cities. Additionally, Chinese BEV exports face resistance in key markets like the European Union, Canada, and the U.S. due to higher tariffs.

Despite these near-term pressures, the long-term outlook appears promising. Trade barriers may be mitigated by increased BEV exports to emerging markets, and the Chinese industry’s scale and technological sophistication position it well for future competition.

China’s structural advantages, including its leadership in LFP batteries and control over the battery supply chain, remain critical. While the U.S. and European markets seek to counter China’s dominance through tariffs, these strategies may not have a lasting impact, especially as China has phased out national subsidies for EV manufacturers and battery sales.

In the long run, China's low-cost, high-quality BEVs could challenge traditional ICE manufacturers, forcing them to lower prices and accept reduced margins. Investors should watch for signs of industry maturation, such as reduced price competition and stabilized market shares.

Western automakers face their own pressures, as they must expand their EV portfolios to secure their futures. Meanwhile, China’s BEV makers and battery manufacturers are well-positioned to thrive in the evolving global market.

The opinions provided here are not intended as research, investment advice, or trade recommendations and may not reflect the perspectives of all AB portfolio management teams. These views are subject to change over time.

China's BEV Industry: Navigating Short-Term Challenges for Long-Term Growth

China's BEV Industry: Navigating Short-Term Challenges for Long-Term Growth

Companies

Companies